The mining sector in Argentina is becoming highly dynamic, providing genuine and sustainable development. The significant geological potential started to awaken over 15 years ago, and seems to advance relentlessly. Official statistics estimate that approximately 75% of the country has not been explored yet.

During the 1990’s, the establishment of a trustworthy legal framework facilitated investments of over US 4,000 M. At that time, an unprecedented increase in production and exports of minerals took place. World-class deposits went into operation: Bajo de la Alumbrera (copper, gold); Cerro Vanguardia (gold, silver), Martha Mine (silver) and Salar del Hombre Muerto (lithium) joined existing operations of Farallon Negro (gold, silver), Andacollo (gold), borates deposits (such as Tincalayu) and Aguilar Mine (silver, lead, zinc) the latter having entered in production in 1936. In 2005, Veladero (gold) also started production in the prolific province of San Juan, and in 2007, San Jose (gold, silver, copper) in Santa Cruz province.

More recently, during 2008 and 2009, Pirquitas (silver, tin), Manantial Espejo (silver, gold), Gualcamayo (gold, silver) and Sierra Grande (iron) went into production, with a combined investment of over US 550 M. Casposo (gold, silver), joined them in 2011 with an investment of US$ 115M. Pascua Lama (gold), the first bi-national project, started its construction in September 2009, with an investment superior to US$ 5.000M and Potasio Rio Colorado (Potassium salts) in 2011. The latest shall constitute the most important potassium exploitation project in the world, with an estimated investment of US$ 5.900 M. Cerro Negro (silver), which was the formidable acquisition of Goldcorp in 2010, is now investing US$ 800M in the project launching.

Other projects that have passed the feasibility studies and/or are waiting for definitions are: Cerro Moro (gold and silver, Extorre), Agua Rica (gold, copper, molybdenum, US$ 2.000M) and Pachón (copper, US$ 4.100M), both of them belong to Xstrata. Lindero (gold and copper US$ 220M, Mansfield), Los Azules (copper, McEwen Mining), Navidad (silver, Pan American Silver).

The mining sector in Argentina is becoming highly dynamic, providing genuine and sustainable development. The significant geological potential started to awaken over 15 years ago, and seems to advance relentlessly. Official statistics estimate that approximately 75% of the country has not been explored yet.

During the 1990’s, the establishment of a trustworthy legal framework facilitated investments of over US 4,000 M. At that time, an unprecedented increase in production and exports of minerals took place. World-class deposits went into operation: Bajo de la Alumbrera (copper, gold); Cerro Vanguardia (gold, silver), Martha Mine (silver) and Salar del Hombre Muerto (lithium) joined existing operations of Farallon Negro (gold, silver), Andacollo (gold), borates deposits (such as Tincalayu) and Aguilar Mine (silver, lead, zinc) the latter having entered in production in 1936. In 2005, Veladero (gold) also started production in the prolific province of San Juan, and in 2007, San Jose (gold, silver, copper) in Santa Cruz province.

More recently, during 2008 and 2009, Pirquitas (silver, tin), Manantial Espejo (silver, gold), Gualcamayo (gold, silver) and Sierra Grande (iron) went into production, with a combined investment of over US 550 M. Casposo (gold, silver), joined them in 2011 with an investment of US$ 115M. Pascua Lama (gold), the first bi-national project, started its construction in September 2009, with an investment superior to US$ 5.000M and Potasio Rio Colorado (Potassium salts) in 2011. The latest shall constitute the most important potassium exploitation project in the world, with an estimated investment of US$ 5.900 M. Cerro Negro (silver), which was the formidable acquisition of Goldcorp in 2010, is now investing US$ 800M in the project launching.

Other projects that have passed the feasibility studies and/or are waiting for definitions are: Cerro Moro (gold and silver, Extorre), Agua Rica (gold, copper, molybdenum, US$ 2.000M) and Pachón (copper, US$ 4.100M), both of them belong to Xstrata. Lindero (gold and copper US$ 220M, Mansfield), Los Azules (copper, McEwen Mining), Navidad (silver, Pan American Silver).

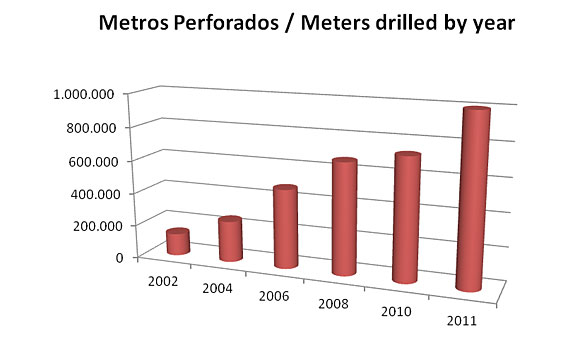

At the same time, the exploration activity continues in several parts of the country, from Jujuy to Santa Cruz, with deposits such as El Altar, Pingüino and Tendal and a large number of lithium projects. The exploration level registered in 2011 beat one million drilled meters along the country.

In order to develop these and other advanced projects, potential investments for more than US$ 15,000 M are estimated in the next five-year period. 50% of these have already been confirmed and are in process.

Argentina counts with 17 important mines in operation -13 of which are metalliferous- and 3 are in construction or production exceeding the 1.6Moz of gold, 19,8Moz of silver y 440,000 Tn of copper, and adding lithium and tin, among other minerals.

Regarding the business outlook, the 2012 statistics are encouraging. Currently, the list of active mining companies exceeds the 145 companies, including important firms such as: Anglogold, Vale, Rio Tinto, Barrick, BHP Billiton, Xstrata and Teck Cominco, medium-sized firms as Pan American Silver, Hochschild and Silver Standard, and juniors such as McEwen Mining, Extorre, TNR Solitario, Mansfield , just to mention some of them. Investments come mainly from Canada, Argentine (through State companies, mainly), United States and Australia. Countries like Switzerland and South Africa have an increasing presence; China, Brazil, Peru and Japan are increasing their participation.

Regarding macro-economy, Argentina is undergoing rough times, since it must face the public expenditure, inflationary process and an exchange rate delay that generate loss of competitiveness to some industries. However, the country is on an unprecedented growth stage in the mining industry, having huge investments in process and encouraging expectations in regard to advanced projects of known resources. At regulatory and Exchange levels, restrictions complicate the operation of some of the projects. However, in this same way, these restrictions are wakening an interest on new players –juniors and majors-. Many of them have a broader view that includes the provincial level in the analysis, reinforced by the distinguished location obtained in the Fraser Institute's ranking for 2011.

Argentina is certainly full of challenges, but the undeniable geological potential, and the sustained growth of the sector guaranties that mining will continue developing year after year, increasing the production of minerals, the identification of new projects and, subsequently, requiring new products, services and human resources.

At the same time, the exploration activity continues in several parts of the country, from Jujuy to Santa Cruz, with deposits such as El Altar, Pingüino and Tendal and a large number of lithium projects. The exploration level registered in 2011 beat one million drilled meters along the country.

In order to develop these and other advanced projects, potential investments for more than US$ 15,000 M are estimated in the next five-year period. 50% of these have already been confirmed and are in process.

Argentina counts with 17 important mines in operation -13 of which are metalliferous- and 3 are in construction or production exceeding the 1.6Moz of gold, 19,8Moz of silver y 440,000 Tn of copper, and adding lithium and tin, among other minerals.

Regarding the business outlook, the 2012 statistics are encouraging. Currently, the list of active mining companies exceeds the 145 companies, including important firms such as: Anglogold, Vale, Rio Tinto, Barrick, BHP Billiton, Xstrata and Teck Cominco, medium-sized firms as Pan American Silver, Hochschild and Silver Standard, and juniors such as McEwen Mining, Extorre, TNR Solitario, Mansfield , just to mention some of them. Investments come mainly from Canada, Argentine (through State companies, mainly), United States and Australia. Countries like Switzerland and South Africa have an increasing presence; China, Brazil, Peru and Japan are increasing their participation.

Regarding macro-economy, Argentina is undergoing rough times, since it must face the public expenditure, inflationary process and an exchange rate delay that generate loss of competitiveness to some industries. However, the country is on an unprecedented growth stage in the mining industry, having huge investments in process and encouraging expectations in regard to advanced projects of known resources. At regulatory and Exchange levels, restrictions complicate the operation of some of the projects. However, in this same way, these restrictions are wakening an interest on new players –juniors and majors-. Many of them have a broader view that includes the provincial level in the analysis, reinforced by the distinguished location obtained in the Fraser Institute's ranking for 2011.

Argentina is certainly full of challenges, but the undeniable geological potential, and the sustained growth of the sector guaranties that mining will continue developing year after year, increasing the production of minerals, the identification of new projects and, subsequently, requiring new products, services and human resources.

Image: Taca Taca Project, Salta

© Por Rojas & Asociados, Consultores mineros